If you’re a growing business, you’ll have registered for PAYE and be handing out payslips each month. With more and more people working in the gig economy and working under non-standard contracts, there is a spotlight on this particular area.

Payslips are a vitally important piece of documentation for your staff. If staff are looking to borrow money such as mortgages, a statement of their gross earnings is proof of income. It is very easy, however, for payslips to be overlooked by employers. But, as employees have a statutory entitlement to an itemised pay slip, it’s crucial that you don’t.

This article looks at whether or not your business is handling payslips correctly and delivers tips on how to stay compliant.

Getting your payslips right

Generally, employers will hand payslips to their staff on or before the day remuneration is dispensed. Payslips contain a wealth of information for employees to track. For example:

- How much the company is paying them over a set time period

- What deductions have been made to their pay (i.e. how much tax was paid)

- Payslips can be given to staff as either a paper document, email attachment or via an online system such as a HR portal.

It is worth noting that some businesses refer to payslips as either “wage slips” or “itemised pay statements”.

Why are payslips important?

Pay has been part of a fairly robust shake-up in legislative terms. It’s gone through changes via the National Minimum Wage and National Living Wage–highlighting evaluation taking place at government level.

Many employers have been caught out trying to circumnavigate UK employment law and denying their staff the right to minimum pay.

A lot has been made of the negative impact of zero or low-hour contracts. Companies have required individuals to be available for work, without meeting their obligations regarding deductions and employee rights.

Who gets payslips?

In the United Kingdom, Payslip Law is addressed in two separate pieces of legislation. Both the Payment of Wages Act 1991 and Employment Rights Act 1996.

Employers are required to give every employee, whether full or part-time, a document to show their pay. This is referred to in the Employment Rights Act 1996.

It doesn't matter whether or not a staff member has joined the company one day prior to payroll being processed, their first payslip may be a part payment but it is still obligatory.

Which staff members need to receive a payslip?

It is imperative that anyone working on behalf of your company is given a payslip in the contractually agreed payroll period. This may be weekly, monthly, quarterly, or even annually in some cases. It applies to workers with:

- Zero-Hours Contracts

- Full-Time Employees

- Part-Time Employees

- Casual Staff

- Temporary Staff

- Seasonal Workers

- And many more…

Agency workers get their payslips from their agency.

Is there anyone who doesn't require a payslip?

There are certain people within the workforce who do not require payslips, albeit this is rare.

Examples of people who do not get payslips include self-employed workers or contractors because they organise their own tax payments and deductions.

There are other types of work in certain industries where people do not receive a payslip, including:

- The Army, RAF, Navy and other Armed Forces

- Police service

- Merchant seaman and woman or crew member working on a fishing vessel with a share of profits

If you're unsure about whether or not someone is employed by you or not, Croner can help. Simply call 01455 858 132.

What needs to be included on a payslip?

Unless you engage with an external payroll company, it may be difficult to initially realise what should be included on a payslip or detailed written pay statement.

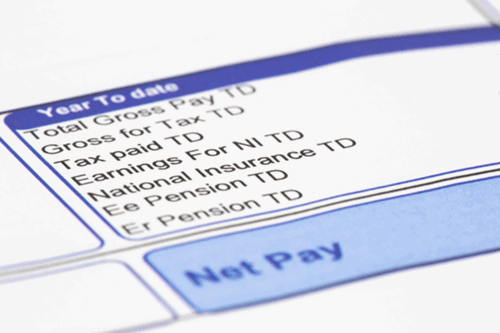

A payslip needs to include the following:

Gross Pay

This is the total gross pay figure paid to the employee or worker before fixed deductions.

Net Pay

This is the total amount paid to the employee or worker after variable / fixed deductions

Variable Deductions

These are the amounts which may vary depending on the amount of money paid to the person. For example, National Insurance, Income Tax, Student Loan Repayments and Pension Schemes.

Wage Breakdown

This is a breakdown of how the wages will be paid to the worker and outline whether this is via more than one method (i.e. bank transfer and cash payment).

The payslip commonly includes the time period the pay covers, a national insurance number and the tax code of the employee or worker. In some cases it may reference trade union subscriptions, but this can be sent on a separate statement.

What happens if a mistake is made on a payslip?

All employers are human, and mistakes can be made. The issue with mistakes on a payslip, however, is that they can have a huge impact on the employee.

Make sure you are processing pay with enough time to get payslips to staff before payday so that any errors can be dealt with in time.

From a HR perspective, if your staff believe there is an error on their payslip, they should speak to a line manager or human resources department as soon as possible. It is important this is dealt with swiftly to avoid grievance issues.

What happens if someone works different hours in a pay period?

If staff are employed on a shift basis or perhaps their working hours are flexible in line with business needs, hours may vary from one pay period to another.

These hours are called variable hours and must appear on a payslip if:

- The member of staff worked overtime

- The number of hours change in each pay period

- The payment rate the employee receives is different for certain working hours (i.e. during Bank Holidays).

There is no right or wrong way to present this information, it can either be shown as a single total or can be itemised. As an employer you can simply choose the best method for you to be able to understand the information.

What if an employee doesn’t receive a payslip?

If you either forget or fail to deliver a payslip to a member of your workforce when expected, the employee should check with a line manager as soon as possible. As soon as you are made aware of an employee not receiving their payslip you should get it to them as soon as possible.

Payslip rule changes

As of 2019, changes were made to payslip law to make things a clearer for both employers and employees. A payslip must now include:

- Time worked

- Demonstrate that all pay is appropriate

- Show that pay is in accordance to legal set minimum requirements

The Employment Rights Act 1996 (Itemised Pay Statement) (Amendment) Order 2018

New payslip law was laid out before parliament in February 2018 called The Employment Rights Act 1996 (Itemised Pay Statement) (Amendment) Order 2018. This was passed and came into force on 6th April 2019.

When should I provide a payroll summary?

According to UK law, employers must provide your employees with a payslip on or before payday. Paydays will vary from business to business and the actual date your staff receive their salary will vary depending on accounting processes. A good payroll team or payroll company will manage this process for you effectively.

Should a payslip be paper or electronic?

Under current UK law, the simple answer is that you, as an employer, can choose. Wage slips can be provided in traditional hard copy or electronic copy. In line with increased emphasis on corporate social responsibility, some companies are using electronic/online payslips to save on paper and ink.

Can employees insist on paper payslips?

You are not obligated to provide an employee with a paper version of their payslips. It makes sense, however, to accommodate staff where possible. The important information may reference expenses, earnings, bonuses, overtime, and fixed deductions which may need to be passed to stakeholders who do not operate digitally or struggle with digital accessibility.

What deductions can employers legally make on a statement?

From time to time it may be possible, as an employer, to make deductions from an employee’s wage. Such instances include:

Law

This is when deductions are required by law such as PAYE tax (according to the employee’s tax code), student loan repayments and National Insurance

Contract

Deductions that have been accounted for in the contract of employment or job description

Overpayment of Wages

This may be part of recovery of a wage that has been overpaid in error or for expenses claims that have been investigated post-payment and are deemed incorrect

Strike Action

Wages that have been paid prior to an employee taking industrial action via strikes

Court Order

Repayments deemed a requisite of a court order

Other deductions which are legal include things like damages and breakages where employers have suffered a loss.

Can Croner help with handling payslips?

If you need assistance understanding what is required when it comes to payslips, Croner can help.

Our award-winning service is used by over 11,000 UK businesses.

Contacting Croner

Speak to a Croner expert today and benefit from our fast and effective advice on 01455 858 132.

Related resources

Categories

- Business Advice

- Contracts & Documentation

- Culture & Performance

- Disciplinary & Grievances

- Dismissals & Conduct

- Employee Conduct

- Employment Law

- End of Contract

- Equality & Discrimination

- Health & Safety

- Hiring & Managing

- Leave & Absence

- Managing Health & Safety

- Moving

- Occupational Health

- Pay & Benefits

- Recruitment

- Risk & Welfare